Share Badr Ait Ahmed Revenue synergies are modelled on a basis-point basis. Human capital risk is assessed with an interview guide. That is not

In every M&A transaction, due diligence is an exposure exercise. Buyers dig — as they should — into liabilities, risks, and vulnerabilities that could erode the value they’re about to acquire.

Most sellers prepare their numbers. They tidy up their contracts. They project confidence in operations. But few prepare with the same discipline when it comes to human capital — the very layer of the business that can derail a deal, delay closing, or deflate valuation.

The irony is sharp: talent is often the most critical asset in a business — and yet it’s the least visible in traditional due diligence preparation.

This is where forward-looking sellers can turn a blind spot into a competitive edge.

Buyers today go far beyond balance sheets. They’re asking:

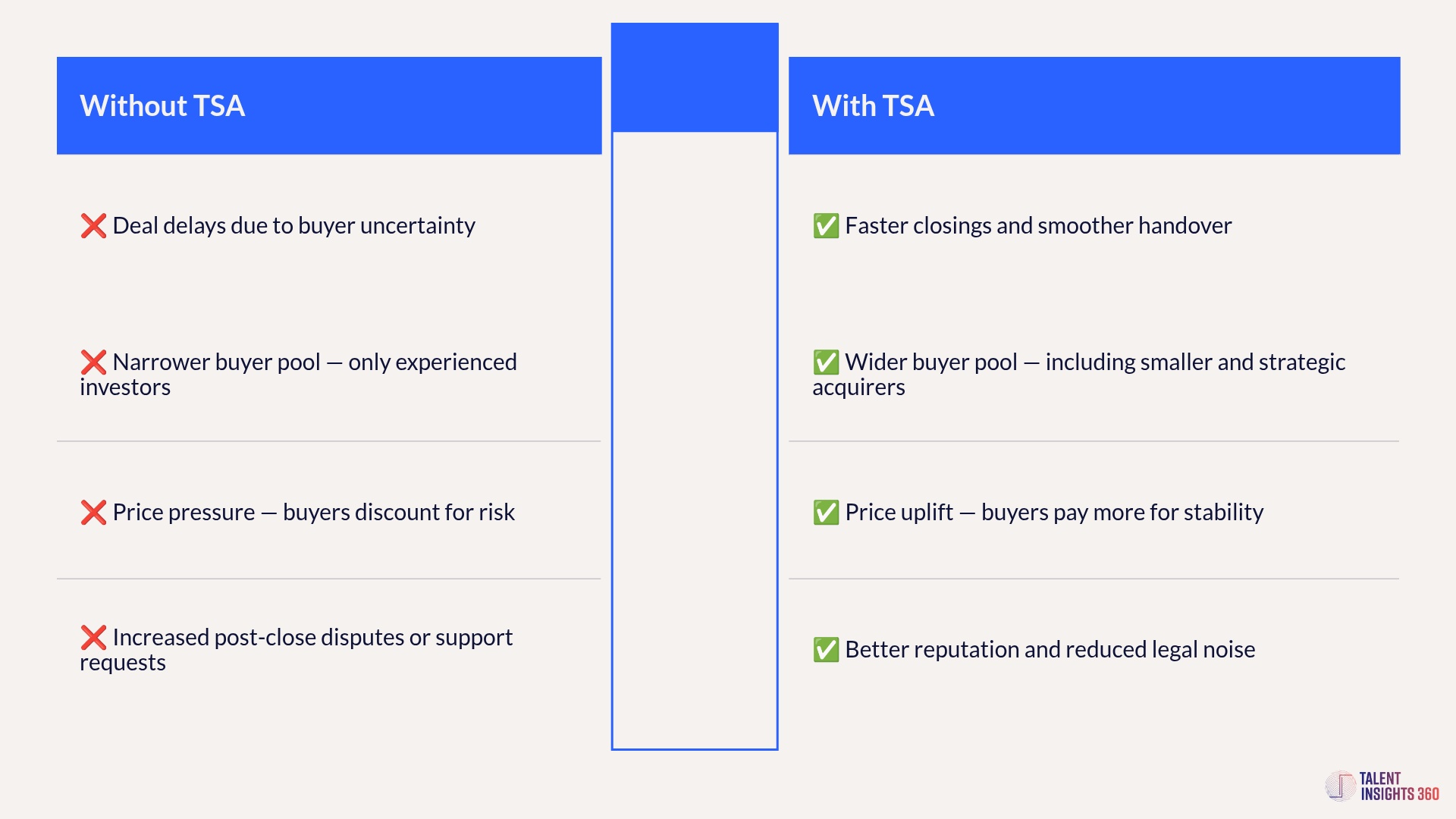

These questions, if unanswered, raise perceived risk, delay closing, or justify last-minute price reductions. Worse, they narrow the buyer pool to only the most experienced and risk-tolerant investors.

Buyers today are cautious, and human capital uncertainty triggers caution.

A Transition Services Agreement (TSA) is a temporary arrangement where the seller continues providing selected services, IT, finance, HR, payroll, etc., for a limited time post-close.

Sellers who shift their mindset — from passive respondent to proactive partner — create a very different impression.

By preparing structured responses to human capital due diligence, and by offering clear Transition Services Agreements (TSAs) in areas like payroll, IT, HR, and operations, sellers signal more than cooperation:

They signal credibility, stability, and confidence in the asset.

And in turn, they unlock deal benefits that go beyond smooth execution.

It’s understandable why some sellers resist TSAs. They want a clean break. They don’t want to tie up people or systems in a business they’ve sold.

But that resistance often backfires.

Here’s what the data and deal outcomes show:

A well-scoped TSA doesn’t need to be open-ended or burdensome. It can be short-term, precisely defined, and priced accordingly. What it does is offer the buyer a bridge — and in doing so, it increases trust, speed, and valuation.

The best time for sellers to prepare is before the buyer begins asking. A few practical steps:

This level of preparation answers questions before they become objections.

It transforms the seller’s position: not just someone offloading an asset, but a partner presenting a de-risked, investment-ready opportunity.

In today’s environment — with more deals competing for fewer premium buyers — sellers need every advantage.

A well-prepared seller:

And it starts by treating human capital not as noise, but as a signal.

If you’re preparing for a sale, human capital should be part of your deal preparation, not just a response to due diligence.

When sellers own this readiness, they don’t just protect value — they create it.

And if at some point, you decide to bring in specialists to help structure this layer — to design the TSA, map the risks, and support the transition — there are experts who do just that.

But first, it begins with the choice to see this issue — and to prepare with intent.

Share Badr Ait Ahmed Revenue synergies are modelled on a basis-point basis. Human capital risk is assessed with an interview guide. That is not

Share Badr Ait Ahmed 60 to 70 percent of your operating cost is people. You optimize procurement with vendor scorecards. Marketing with attribution models.

Share Badr Ait Ahmed The U.S. military figured out strategic workforce planning in the 1970s. Most Fortune 500 companies still haven’t. Hidden in defence

Share Badr Ait Ahmed “Culture fit” might be the most dangerous phrase in M&A. Nearly every executive claims cultural alignment matters—yet the data tells

Share Badr Ait Ahmed Why Automating the Back Office Won’t Transform the Business—and Why Most AI Projects Fail Trying The Efficiency Obsession In boardrooms

Share Badr Ait Ahmed Since 2000, companies have spent more than $57 trillion on mergers and acquisitions. That figure represents the largest sustained transfer of