Share Badr Ait Ahmed Revenue synergies are modelled on a basis-point basis. Human capital risk is assessed with an interview guide. That is not

Geopolitical instability, tariffs, and digital disruption have significantly changed today’s deal environment. Strategic mergers and acquisitions (M&A) dropped by 39% after the tariffs were implemented in April 2025, marking the end of an era characterized by the free flow of capital, goods, and talent. In this challenging climate, private equity (PE) firms face tighter profit margins, slower deal cycles, and increased execution risks.

The focus has shifted from simply evaluating financials to assessing whether leadership and the workforce can deliver results. Traditional due diligence often overlooks this critical aspect. While deal teams evaluate factors like pricing power, regulatory exposure, and AI-related risks, they frequently neglect the most essential element that underpins all these considerations: human capital.

In a world where resilience and speed are paramount, human capital due diligence should be regarded as a fundamental requirement rather than a post-closing remedial step. Talent, leadership, and cultural alignment have become central to creating value. The sooner firms make this adjustment, the better their outcomes will likely be.

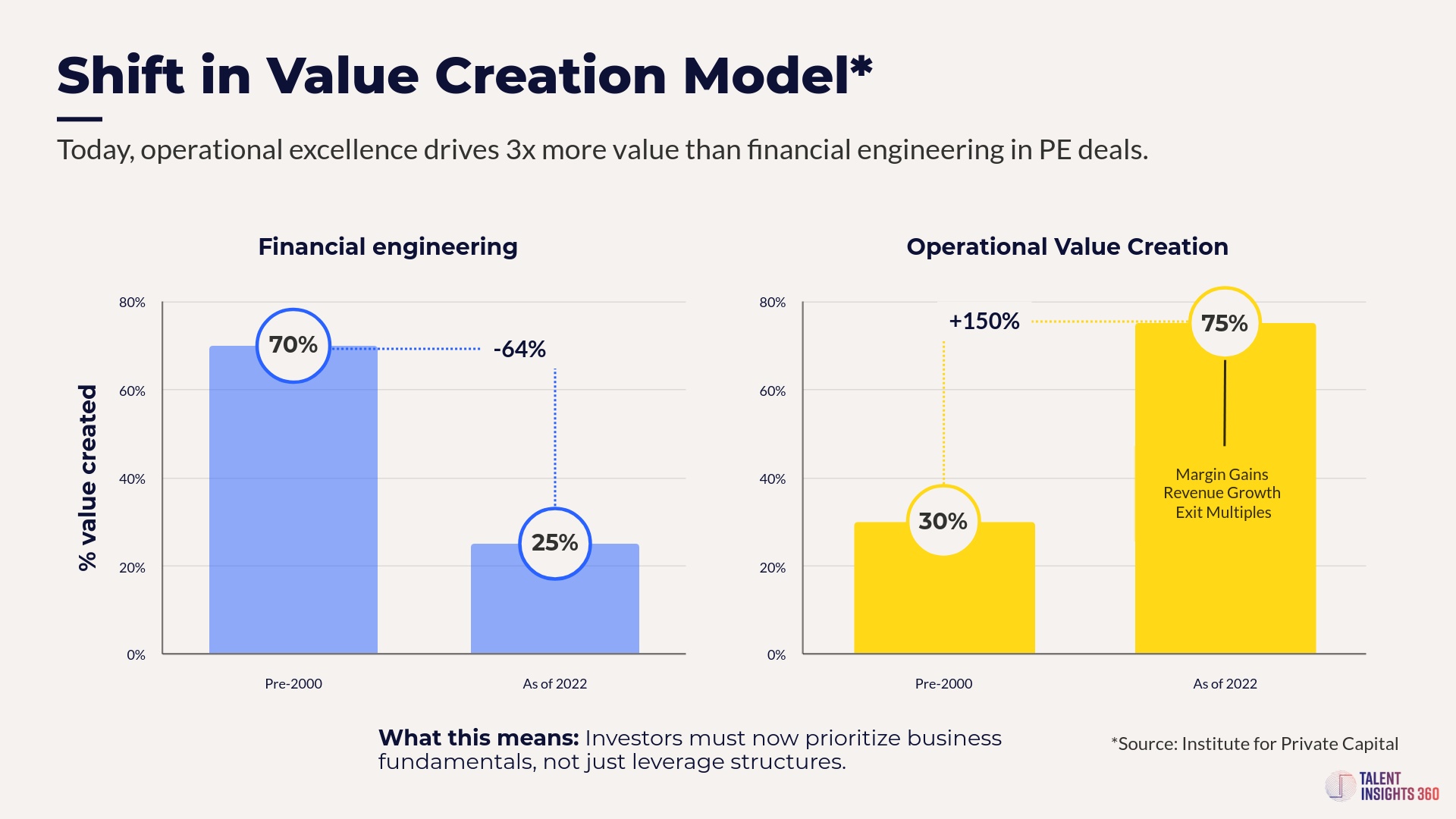

Historically, 70% of PE value creation came from financial engineering—debt leverage, recapitalizations, and arbitrage. That number has dropped to just 25%. Today, 75% of the value stems from operational improvements and multiple expansions.

This shift demands a strategic pivot: PE firms must now understand and optimize the talent, Culture, and leadership within portfolio companies. Yet many still treat human capital as an afterthought in due diligence. That is no longer sustainable.

Many PE deal models fail because they overlook the true financial impact of workforce-related issues. Attrition, misalignment, and cultural friction can delay synergies, erode returns, and reduce EBITDA.

These hidden costs can run into the millions—yet they’re rarely captured in due diligence. It’s time to fix the broken margin equation by factoring human capital into every investment model.

Talent creates value for an organization by driving Innovation, improving Performance, and enhancing Competitiveness.

Skilled employees apply their expertise to solve problems, optimize processes, and innovate products or services, which can lead to increased Efficiency, higher quality outputs, and Productivity.

Additionally, a talented workforce can better adapt to market changes and challenges, supporting Sustainability and Growth.

Effective talent also strengthens organizational Culture, attracts other high-quality employees, and boosts Engagement, all of which contribute to long-term organizational success.

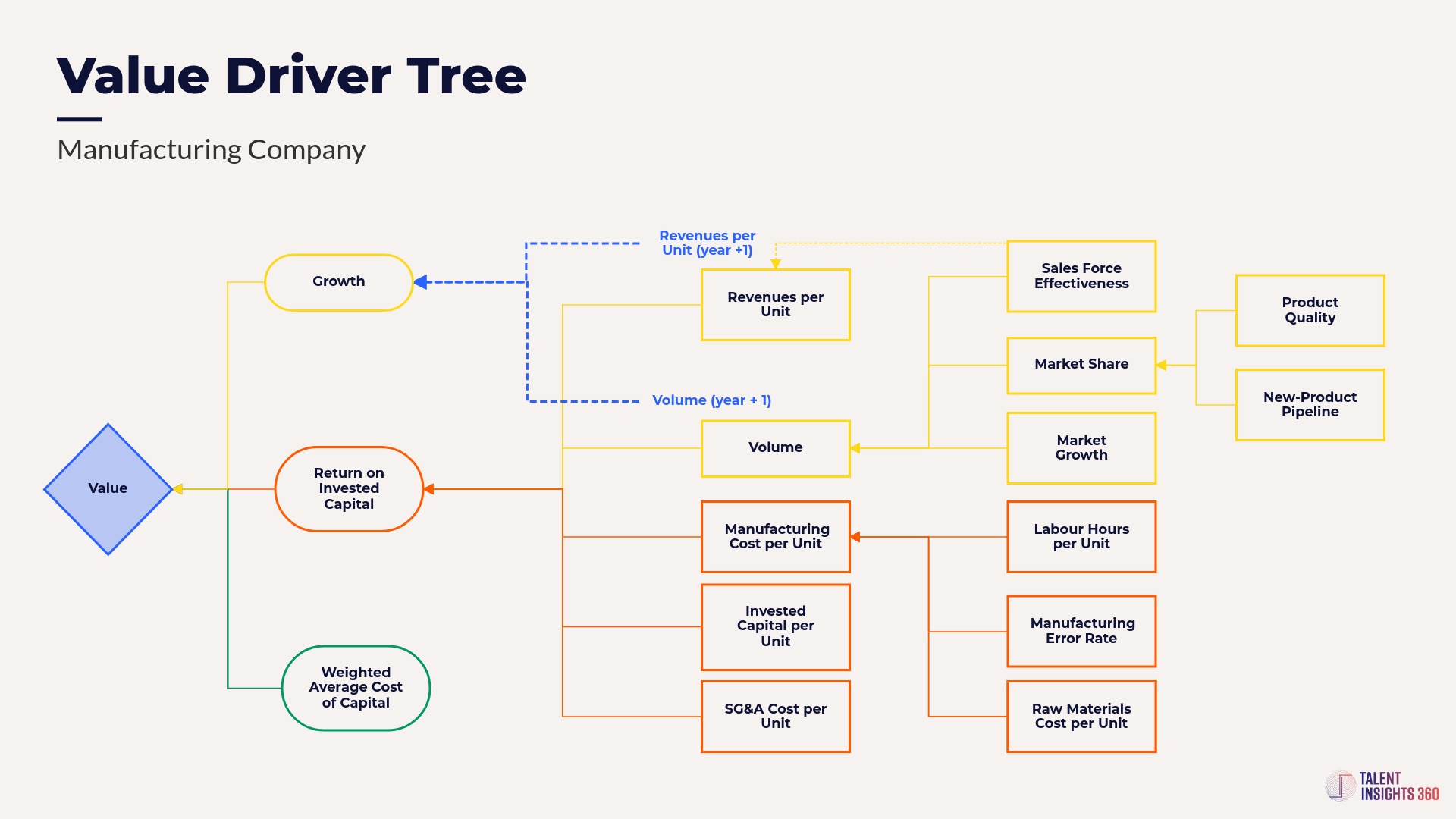

While our example focuses on the manufacturing industry, the core logic applies across sectors. In service or software businesses, the metrics may differ, such as revenue per user or cost per transaction, but the principle remains the same: human capital directly impacts unit economics, whether it’s unit cost or unit revenue.

In manufacturing, as in most sectors, human capital drives enterprise value by enabling Growth, controlling costs, and reducing risk. Below is a breakdown of how talent links directly to core financial levers:

Traditional HR checklists won’t cut it. Generic assessments like resume reviews, leadership interviews, headcount ratios, or basic turnover metrics also fall short.

Human capital due diligence must be:

2025 has become a pivotal year for private equity. Macroeconomic instability with underlying constraints—like tighter LP liquidity, elevated acquisition multiples, and rising execution risks—forces GPs to prove value creation earlier and more precisely.

Several dynamics are now converging:

In short, the margin for error has shrunk. Human capital due diligence must become a standard part of investment rigour—if not, firms risk overpaying for underperformance.

It’s time for private equity to treat talent like capital. Human capital must be assessed, modelled, and managed with the same rigour as financial metrics.

Deals are won or lost not just by the numbers on a spreadsheet but by the people executing the plan.

PE firms must act now to deliver superior returns in a market with tighter margins and longer hold periods. Revisit the ‘Strategic Ask‘ and embed data-driven human capital assessments into your due diligence and value creation playbook. Make talent a measurable lever in every investment thesis.

A data-driven talent strategy is no longer optional. It’s the missing lever PE firms must pull to unlock Growth, protect margins, and outperform the market.

Share Badr Ait Ahmed Revenue synergies are modelled on a basis-point basis. Human capital risk is assessed with an interview guide. That is not

Share Badr Ait Ahmed 60 to 70 percent of your operating cost is people. You optimize procurement with vendor scorecards. Marketing with attribution models.

Share Badr Ait Ahmed The U.S. military figured out strategic workforce planning in the 1970s. Most Fortune 500 companies still haven’t. Hidden in defence

Share Badr Ait Ahmed “Culture fit” might be the most dangerous phrase in M&A. Nearly every executive claims cultural alignment matters—yet the data tells

Share Badr Ait Ahmed Why Automating the Back Office Won’t Transform the Business—and Why Most AI Projects Fail Trying The Efficiency Obsession In boardrooms

Share Badr Ait Ahmed Since 2000, companies have spent more than $57 trillion on mergers and acquisitions. That figure represents the largest sustained transfer of